Sales Return For Gifts & Books

Company

TOUCHSTONE FOUNDATION VRINDAVAN – NCR

1. Sales Return Process

1.1 Open Sales Invoice

- Go to Selling → Sales Invoice

- Click create a New Sales Invoice

- Tick the checkbox Is Return

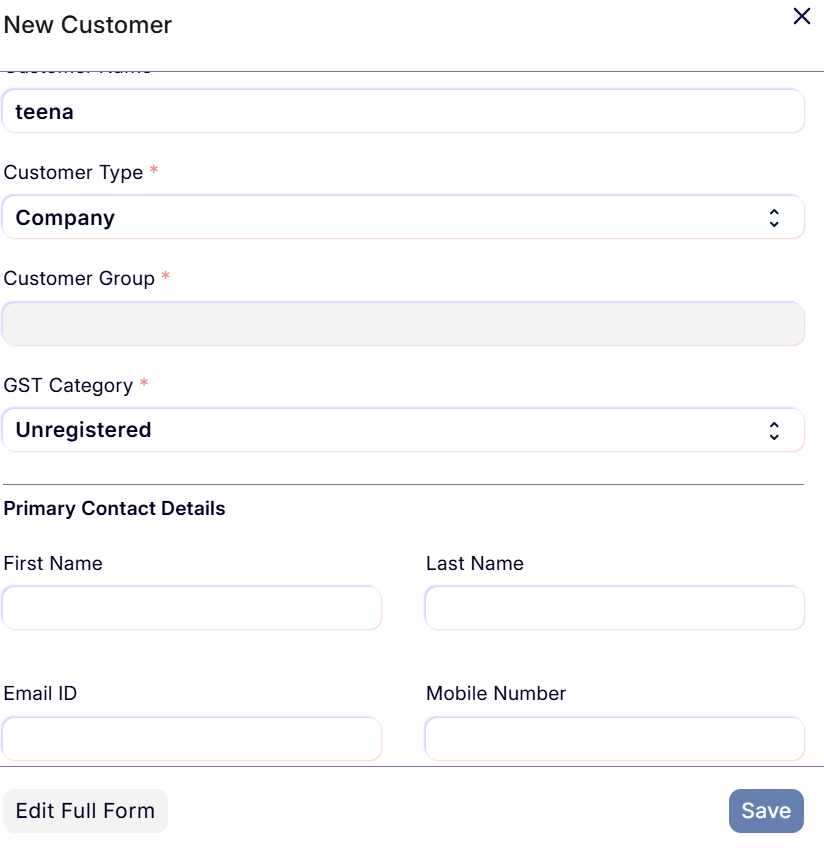

1.2 Customer Selection / Creation

- Search customer in Customer field

- If customer is not available:

- Create a new customer (Click on Create a new Customer then Box will open)

- Customer Group: Gifts and Books

- Mobile No. is mandatory

- Other info also (like address, email etc.) can be taken

- Select the customer present in this group

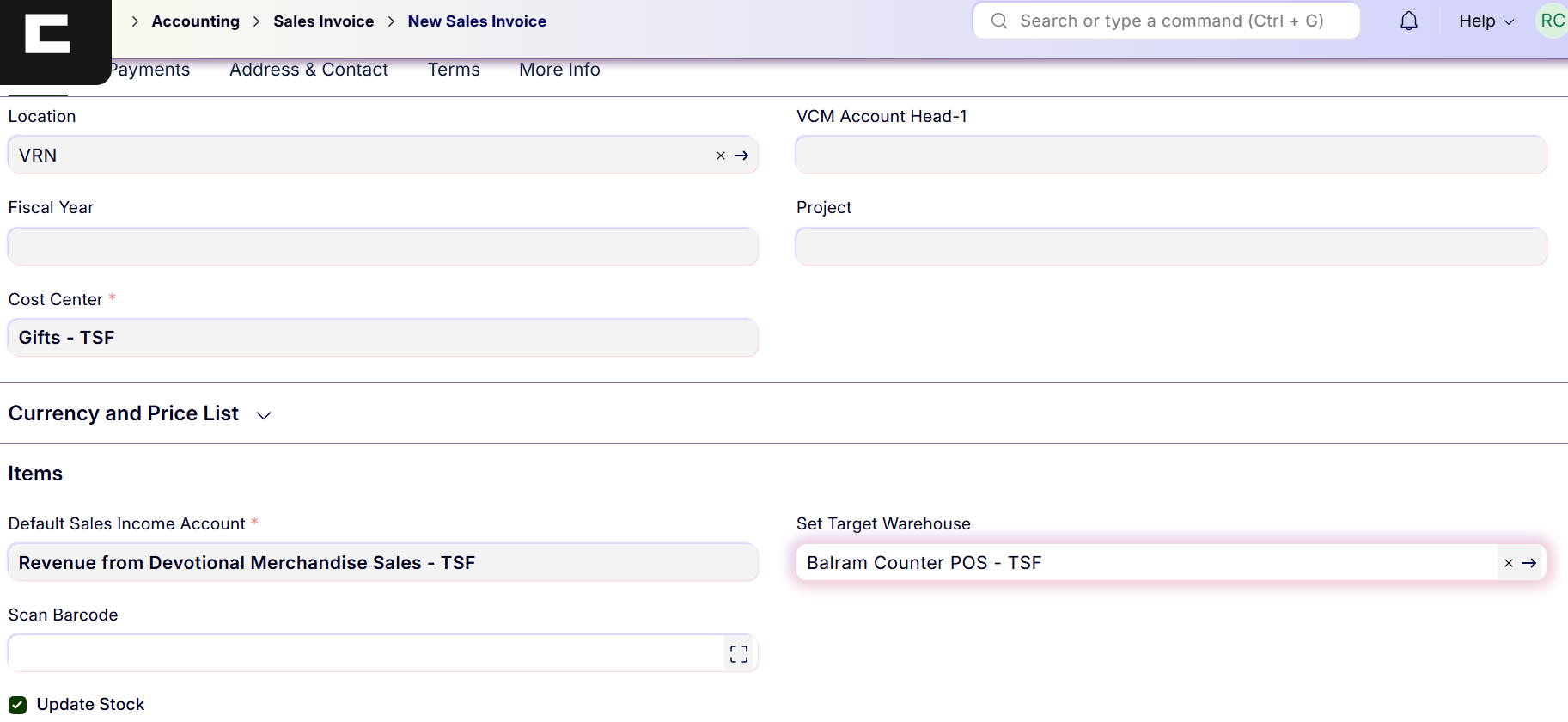

1.3 Basic Details

- Company: TOUCHSTONE FOUNDATION VRINDAVAN – NCR

- Cost Center: Gifts or Books

- Location: VRN

1.4 Stock and Accounting Details

- Select the warehouse where the return item will come

- Tick the checkbox Update Stock

- Default Sales Income Account:

Revenue from Devotional Merchandise Sales - TSF

1.5 Item Details

- Select the item

- If multiple items, add a new row

- Quantity must be negative (e.g. -1)

1.6 Additional Information

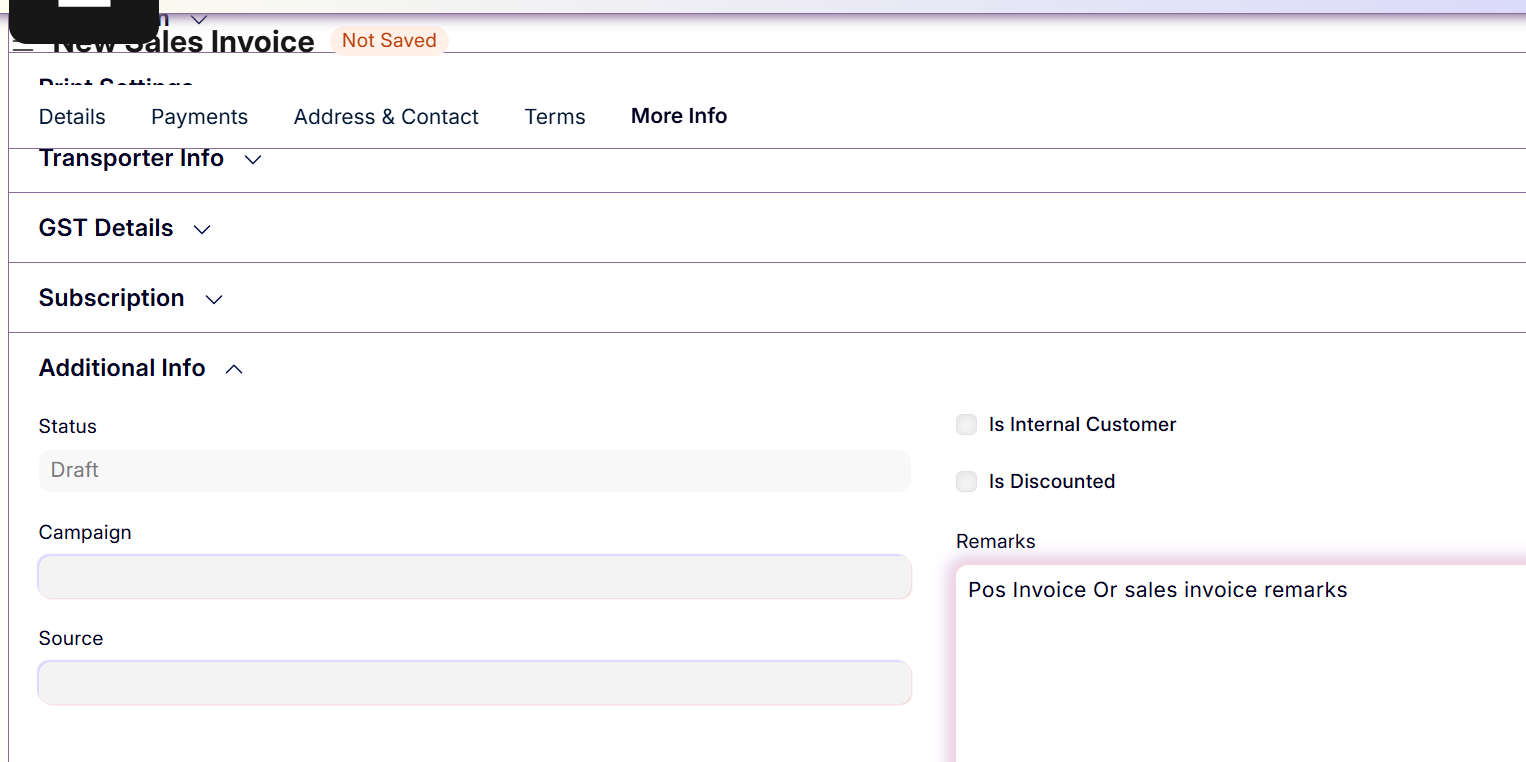

- Go to More Info tab

- In Additional Info / Remarks, mention the POS Invoice number

1.7 Save and Submit

- Save the Sales Return

- Check all details

- Submit the Sales Return

2. Sales Invoice for Bill Exchanged Items

2.1 Create Sales Invoice

- Go to Selling → Sales Invoice

- Click New

2.2 Customer and Company Details

- Select the same customer as in the Sales Return invoice

- Company: TOUCHSTONE FOUNDATION VRINDAVAN – NCR

- Cost Center: Gifts or Books

- Location: VRN

2.3 Stock and Accounting Details

- Select the warehouse from where item is going

- Tick the checkbox Update Stock

- Default Sales Income Account:

Revenue from Devotional Merchandise Sales - TSF

2.4 Item Details

- Select the item

- If multiple items, add a new row

- Quantity will be positive

2.5 Additional Information

- Go to More Info tab

- In Additional Info / Remarks, mention the return Sales Invoice number

2.6 Save and Submit Bill

- Ensure the bill amount is greater than the return amount or same

- Save the Sales Invoice

- Check all details

- Submit the bill

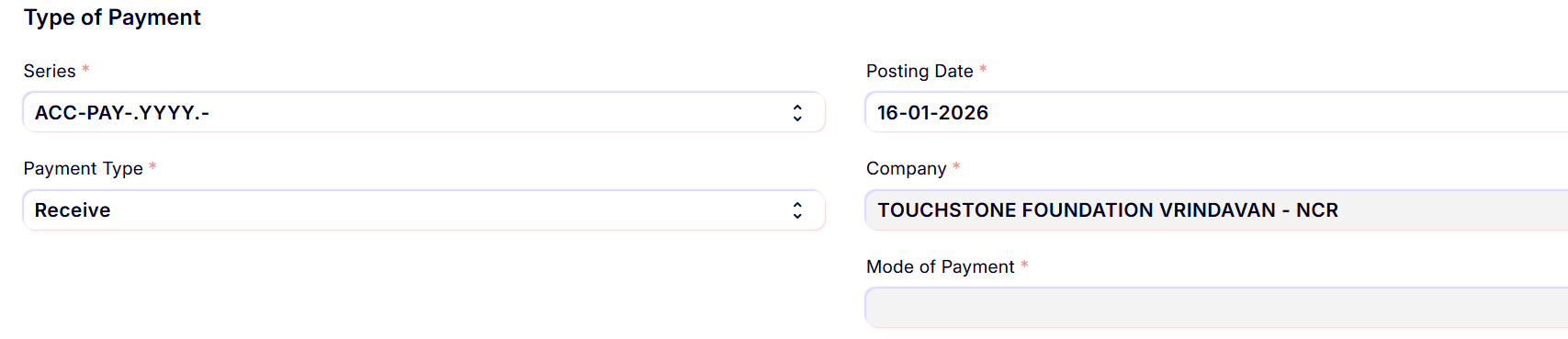

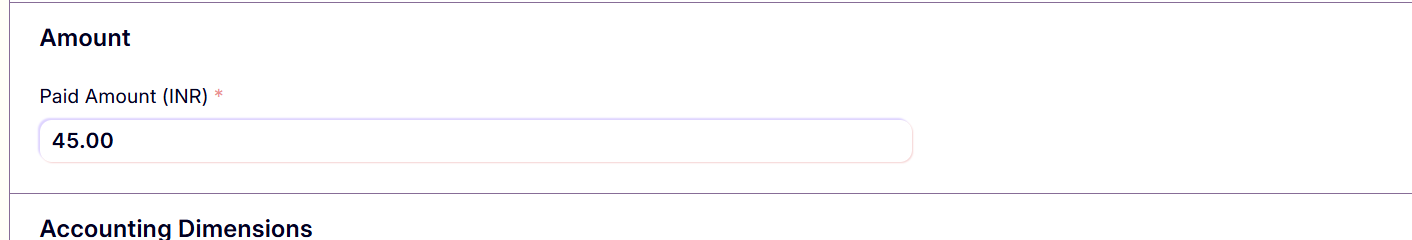

3. Payment Entry

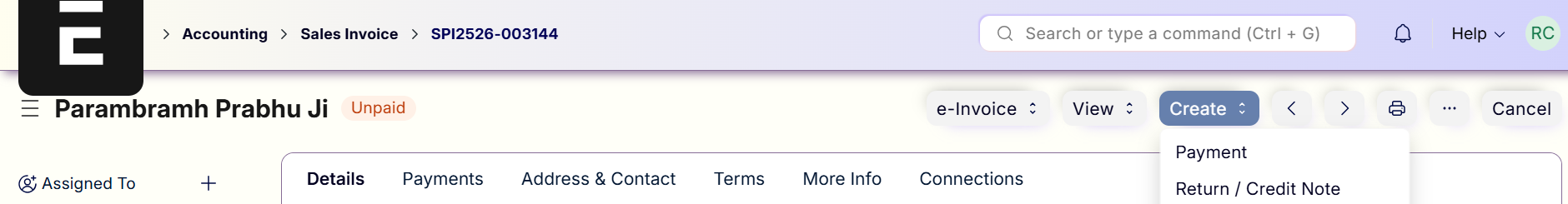

3.1 Create Payment Entry

- Open the billed Sales Invoice

- Click Create → Payment Entry

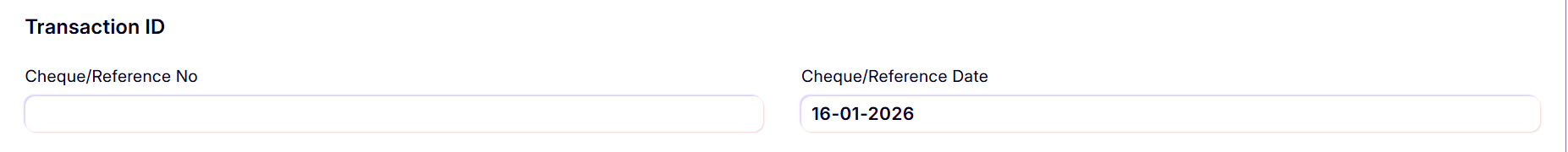

3.2 Payment Details

- Select the Mode of Payment

2. Fill the Paid Amount

2. Fill the Paid Amount

(Difference of return amount and new bill amount)

- Fill the Reference Number

3.3 Save and Submit Payment

- Save the Payment Entry

- Check all details

- Submit the Payment Entry

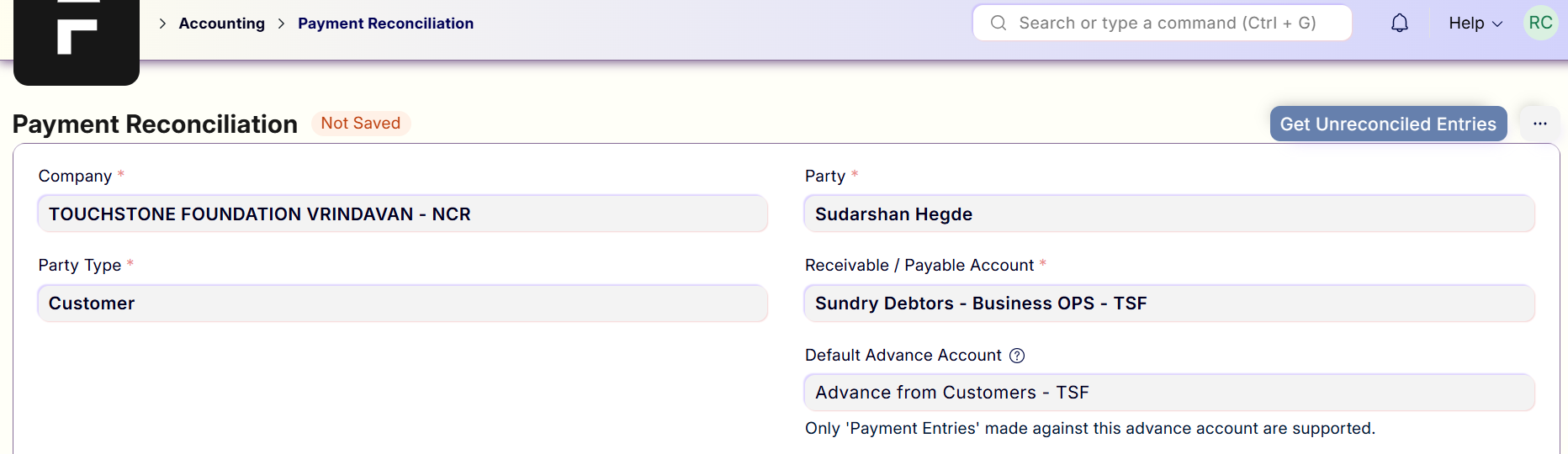

4. Payment Reconciliation

4.1 Open Payment Reconciliation

- Search Payment Reconciliation

- Open the Payment Reconciliation tool

4.2 Set Filters

- Company: TOUCHSTONE FOUNDATION VRINDAVAN – NCR

- Party Type: Customer

- Party: Customer for whom Sales Invoice was created

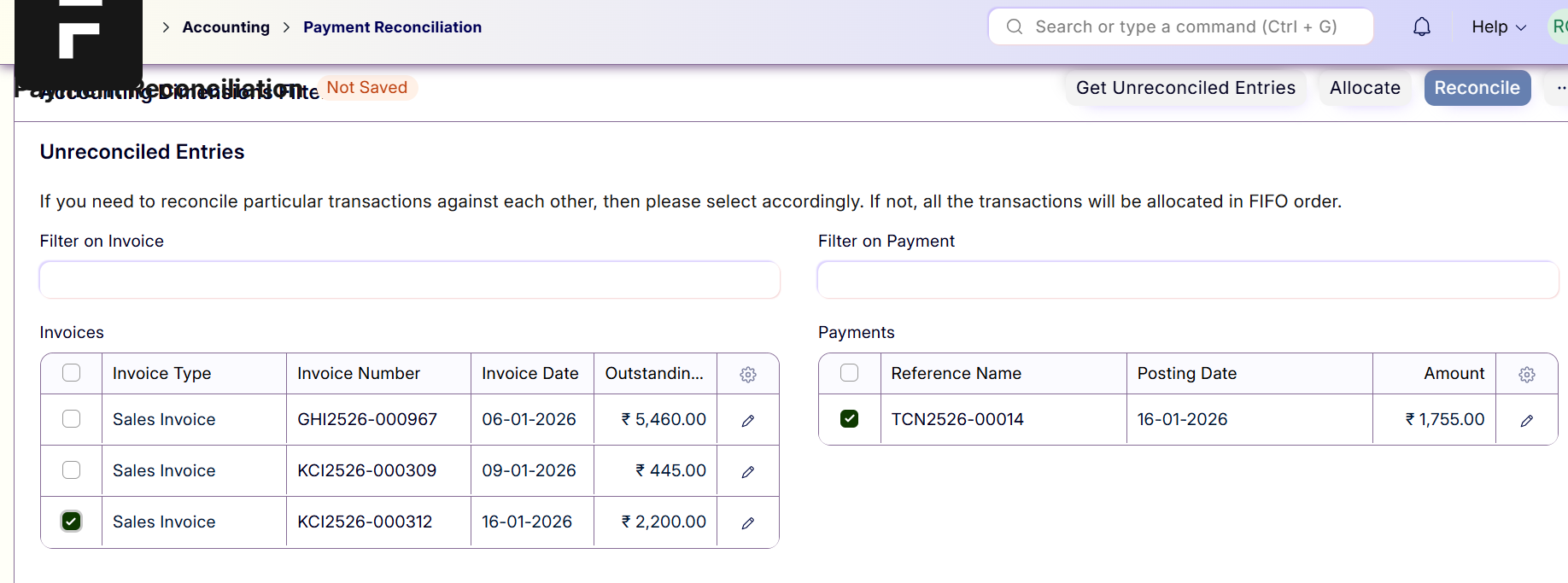

4.3 Reconcile Entries

- Click Get Unreconciled Entries

- Select the Sales Invoice, Sales Return, and Payment Entry

- Click Allocate

- Click Reconcile

4.4 Verification

- Sales Invoice outstanding amount should be zero

- Sales Return outstanding amount should be zero

Additional Info

- Return policy is decided by Finance and concerned department

- For now 7 days Return Policy from date of POS Invoice and Credit Note can be exchanged till 3o days from date of Posting Credit Note

2. Fill the Paid Amount

2. Fill the Paid Amount